(Too long; didn’t read resume at the end of the article. I strongly invite you to at least check the charts, which are worth 1,000 words.)

Since 2020, the bond market, traditionally seen as the safest and most liquid market, has experienced unprecedented dynamics (at least compared to recent times).

Many factors are responsible: Quantitative Easing from the post-Great Financial Crisis and COVID period, the consequent tightening from central banks, and global governments’ spending addiction.

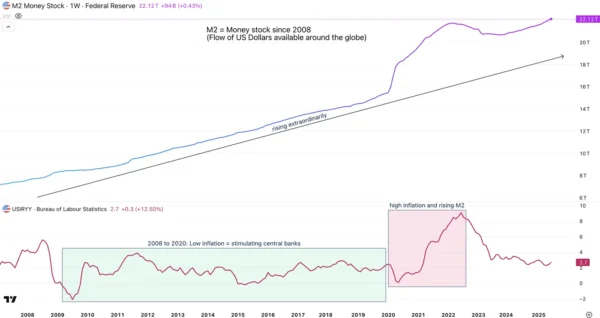

From 2008 to 2021, low inflation and a somewhat sluggish economy required easy monetary conditions to stimulate job creation and every other positive aspect that a more efficient labor force creates (including the quintessential credit creation).

Inflation is closely tied to government bond yields; with slowing inflation, longer-run government bond yields have been held between 0% (or even negative) to 2% throughout most economies in that same period.

This phenomenon allowed governments to subsidize companies and programs to boost the economy, using what is vulgarly called “cheap money creation”.

One could debate that it now has broadly negative consequences, but without it, the COVID era would have led to a decade-long recovery process and a much more considerable economic crisis.

However, as the economy quickly recovered from the COVID crisis, inflation rose sharply (close to 10% year-over-year) in the US, Canada, Europe, and throughout the globe.

This caused bond yields to shoot higher, leading to higher inflation expectations and forcing central banks to hike interest rates aggressively from 2022 to 2023.

In an ideal world, government spending would slow as fast as economic recovery would be completed.

However, a too-indebted global economy has become addicted to borrowing, and governments are having a tough time slowing down their hunger for debt. (But are they really trying?)

That forces high-spending governments to spend even more to finance their increasing debts—for comparison, as an individual, it’s as if one would take a second mortgage to help repay a first, too large mortgage at higher rates (not a good deal).

If you’re watching the headlines, you will notice that President Trump is complaining almost daily about the higher interest costs from the US government and tries to force the Federal Reserve Chair Powell to lower rates, for the US to reduce their interest costs – but doing so would greatly raise longer-run inflation expectations

With decreasing inflation, government yields should traditionally be heading down—but after 20 years of extremely low yields, this correlation is inverting.

With a sufficient explanation of the situation, let’s watch a few charts that paint the current picture.

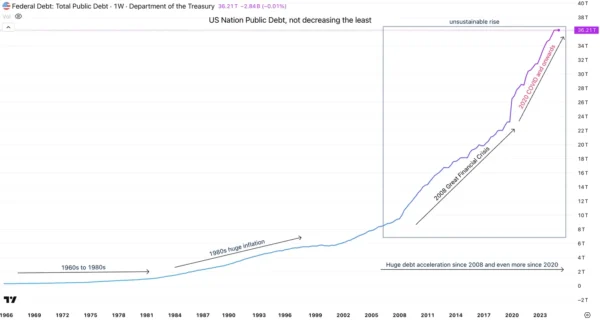

US Government debt since 1960

US Public Debt – Source: St Louis FED and TradingView

US inflation and global money creation (M2) since 2008

The Rise of M2 and how it made inflation shoot up – Source: TradingView

Essentially, money creation makes M2 rise, which props up inflation (more money for the same goods = price of goods rises)

When governments spend, they print (or create) money which creates inflation.

Long-run bond yields (30Y) from 2020 to 2025 (US, Europe, Japan and UK) and long-run inflation expectations

30Y Yields for US, UK and Europe with US inflation expectations below – Source: TradingView

So what about the current situation: The FED should cut rates and 30Y Yields are shooting higher, but why?

So why is inflation heading lower but government bond yields are rising ?

The reason is simple, short term interest rates move on central banks’s main rate expectations, and this is closely linked to immediate inflation (like headline CPI for example).

However, 10Y yields and onwards (which are the base of all consumer-mortgages) are more influenced by future (long-run) inflation expectations, future costs of government debt and credit creation (heavier credit = higher yields).

These go up from looser fiscal policies (like the Big, Beautiful Bill from the Trump Administration or the current mess-ups in the United Kingdom) and a decreasing investor confidence. A higher risk demands higher compensation.

These three components are rising sharply, hence, government bond yields are shooting higher, with the latest case in the UK pushing higher yields in the US and even in Japan where the 30 year yield just reached multi-decade highs.

Also, tariffs increase inflation, which pushes yields higher.

Independent central banks (particularly the Federal Reserve which manages the flow of the US Dollar, the global reserve currency) are more than essential to preserve the value of money, which helps to reduce inflation further and maintains the value of everyone’s precious fiat money.

Governments slowing down their spendings would be of much help.

(All of these dynamics contribute sharply to diversification towards metals, cryptocurrencies, and other asset classes)

(TL;DR) – Too long, didn’t read

- Since 2020, the bond market — usually the safest and most liquid — has seen historic volatility – Bonds selling = higher yields.

- Years of QE (post-GFC, COVID) + government spending created “cheap money” conditions that fueled growth but stored up risks – higher risks = higher yields.

- From 2008–2021, inflation stayed low, keeping long-term yields near 0–2% across developed economies – past two decades of low yields = cheap money = spending addiction from governments.

- Post-COVID, inflation spiked near 10% globally, forcing central banks into aggressive 2022–2023 hikes = government costs rise sharply – Normally, governments stop spending from here, but they’re not.

- Normally, falling inflation = lower yields, but this link is breaking down – High spending in decent economies = high inflation expectations.

- Short-term yields follow central bank policy expectations, but long-term yields reflect future inflation, fiscal debt, and credit demand.

- If main rates (like the FOMC 4.50% rate that should go down in the upcoming FED Meeting) go down while economy is good, future inflation exp, hence bond yields shoot up.

Looser fiscal policy, tariffs, and weak investor confidence are also driving long-term yields higher. - Governments are stuck in a debt spiral: borrowing more at higher costs to cover past debts.

- Political pressure (e.g., Trump vs. Powell) risks undermining central bank independence — crucial for preserving the value of money and keeping inflation anchored.

- This structural shift in bonds is fueling diversification flows into metals, crypto, and other alternatives.

Safe Trades!