- Gold at record high: Gold surged to $3,549.66/oz, up 33% in 2025, as investors seek safe-haven assets amid global uncertainty.

- Fed policy drives momentum: Expectations of U.S. Federal Reserve rate cuts and political interference fears boost precious metals demand.

- Silver outshines gold: Silver breaks $40/oz for the first time since 2011, up 40% YTD, fueled by industrial demand and tight supply.

Gold Hits All-Time High Amid Flight to Safety

Gold prices reached a new all-time high of $3,549.66 per ounce, reflecting a broader trend of growing investor appetite for safe-haven assets amid worsening sentiment in global equity and bond markets, and rising political and economic uncertainty. In just the past seven trading sessions, gold has climbed by over 5%, and since the beginning of the year, the metal has gained more than 33%, making it one of the best-performing assets of 2025.

Daily chart of Gold, source: TradingView

Fed Rate Cut Expectations Fuel Momentum

The rally in gold is primarily driven by expectations of an upcoming rate-cutting cycle by the U.S. Federal Reserve, which enhances the attractiveness of non-yielding assets like gold. Investors are also reacting to growing concerns about the Fed’s independence — President Trump has reportedly considered removing one of the central bank’s board members, raising fears about the future direction of monetary policy. Additional uncertainty stems from fiscal instability in developed economies and ongoing geopolitical tensions, both of which are pushing capital toward precious metals.

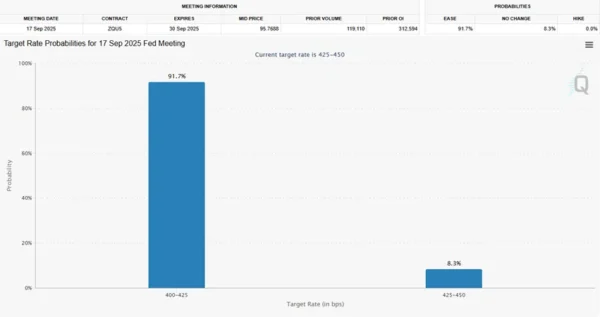

Probabilities of changes to the Fed rate, as implied by 30-Day Fed Funds futures prices., source: CME FedWatch Tool

Silver Outpaces Gold on Industrial and Investment Demand

Silver has shown an even more impressive performance, breaking above $40 per ounce for the first time since 2011. Year-to-date, silver is up by approximately 40%, outperforming gold both in terms of return and demand dynamics. Beyond macroeconomic factors, silver is also benefiting from robust industrial demand, particularly in the green technology sector — including solar panels and other renewable energy components. The physical silver market is facing its fifth consecutive year of supply deficit, which is fueling investor interest in silver-backed ETFs. Shrinking inventories in London vaults and persistently high leasing costs (around 2%) point to tight physical availability of the metal.

In the near term, the precious metals market is expected to remain highly sensitive to political and macroeconomic developments. Investors are awaiting a ruling by the U.S. Supreme Court on the legality of removing a Fed board member, as well as the announcement of a new nominee for Fed Chair — Jerome Powell is set to step down in May 2026. Upcoming U.S. labor market data will also be crucial in shaping the Fed’s next monetary policy moves. Adding to the uncertainty is the ongoing trade dispute, with President Trump announcing plans to appeal a court decision that ruled parts of existing tariffs illegal — a move that could further escalate global trade tensions.

Daily chart of Silver, source: TradingView